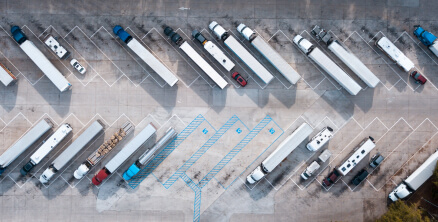

Customized Trucking Insurance

We provide comprehensive coverage for all industries.

See What People Are Saying About Us

Why Russell

Russell Agency offers tailored coverage for your personal, professional, and commercial insurance.

Over 30 years of experience in providing insurance services.

Save up to 20% on premiums with Russell Agency.

We’ve helped in the growth of 1000+ businesses.

We keep it safe and compliant

Our team of agents helps keep your trucking business compliant by offering CSA score monitoring as a value-added service. We use CSA scores to assess the overall risk of motor carriers and advise truckers on obtaining more inspections to counteract negative impact.

Insurances by Profession

Get specialized coverage for professionals. We understand that different professions require different insurance solutions.

Freight Brokers and Forwarders

Owner

Operators

Motor

Carriers

Trucking Companies

Big L Boyz LLC saves money and gains peace of mind with Russell Agency

“We chose to go with Russell Agency because they’re the best in trucking insurance. We felt that they spoke our language and understood our pain points completely. They steered us toward a solution that made sense. We are really happy with the results as we were able to grow our operation from 4 trucks to 5 within a year!”

Insurances by Coverages

Our wide range of coverage options ensure you’re protected at every step of the journey.

Things You Should Know

Who needs it?

415,000 police-reported crashes involving large trucks in 2020.

If you own a trucking company, you know that accidents can happen, and the cost of repairing or replacing a truck can be astronomical. That’s where trucking insurance comes in.

If you operate a commercial truck, you likely need trucking insurance. This includes anyone who:

- Owns or leases a truck,

- Operates as an independent contractor

- Provides trucking services for hire.

What’s the cost?

The cost of trucking insurance can vary depending on factors such as:

- Type of truck

- Cargo

- Driving history

- USDOT authority

- Coverage requirements

- Operating radius